Bankruptcy Can Happen to Anyone

According to the United States Supreme Court,

“The primary purpose of bankruptcy is to…relieve the honest debtor from the weight of oppressive indebtedness and permit him to start afresh free from the obligations and responsibilities consequent upon business misfortunes.”

Williams v. United States Fidelity & Guaranty Co., 236 U.S. 549, 554 (1915)

Bankruptcy laws exist because unfortunate things can happen to anyone. In fact, over 7,800 bankruptcy petitions were filed in Northern California in 2019 alone.

If you’re thinking about filing for bankruptcy but are afraid, keep in mind that you are in good company. In the first 6 months of 2020 alone, Nieman Marcus, 24-hour Fitness, JC Penny, Gold’s Gym, J. Crew, Avianca Airlines, the Boy Scouts of America, Hertz, Lucky grocery stores and others have used the Code to adjust or relieve their debts.

Filing for bankruptcy may or may not be the best course of action for you, but you will not know your options until you review each possibility. Speak to an experienced and qualified attorney to see if you might benefit from bankruptcy, a workout outside of bankruptcy, or other course of action.

At some point or another, most of us will be affected by a bankruptcy.

This may happen when businesses attempt to collect on an overdue debt, or have collected one only to be sued for a preferential transfer by a debtor’s bankruptcy estate. It may also happen when a tenant files for bankruptcy, or when a landlord files for bankruptcy and we are renters. It may happen when a friend, relative or someone for whom we guaranteed a loan files for bankruptcy and we are called upon to honor the guarantee. Or, it may happen when we find ourselves unable to make ends meet due to unexpected events such as illness, job loss, or what in hindsight turns out to be a mistake in financial planning.

Bankruptcy is for everyone’s benefit.

The fact is that the bankruptcy laws are designed to help both debtors and creditors. For debtors, a bankruptcy discharge offers a fresh start to the honest but unfortunate, or simply a chance through the automatic stay to regroup and analyze how to handle financial problems. For creditors, the bankruptcy process offers an orderly liquidation or payment plan without the time, cost and uncertainty of costly traditional litigation, and it stops the race between creditors to be first to grab dwindling assets of an undercapitalized debtor.

Bankruptcy is not immoral.

When we hear the word “bankruptcy,” many may shrivel their noses and think of the debtor as a deadbeat or immoral. In most cases, nothing could be further from the truth.

Most debtors, whether business or individuals, have to grapple with emotions of failure even to consider taking the step of filing. Most individual debtors are filing for the first time, and have been beset by unexpected losses such as severe illness, job loss, personal identity theft or divorce. When one considers that the national divorce rates are about 3.5% every year, or that over 60 million Americans have lost their jobs or businesses due to Covid-19 in the past three months alone, it becomes a little easier for the rest of us to understand the potential debtor’s predicament. Bankruptcy is provided for in the US Constitution. It is as American as can be.

Similarly, a vast number of businesses fail in their first five years. The US Census Bureau does not track business failures, but the National Federation of Independent Businesses cites a study conducted by Wells Fargo Bank stating that nearly 50% of all start-up businesses close in the first five years.

In short, the words entrepreneurship and illness are not synonymous with deadbeat or immorality. Rather, failure is a byproduct of effort and should not be looked at with disdain. Better that we all jump into the bankruptcy process (whether as debtor or creditor) and get on with life and our businesses.

Not all bankruptcies are alike.

Many think of bankruptcy as economic death when instead it should be viewed as a fresh start. A bankruptcy case is more akin to a phoenix-esqe event in that individual debtors continue after bankruptcy free of most of their debts. And, many business bankruptcies also are not liquidation-style cases. Many bankruptcies are filed under Chapters 9 (municipal reorganization), 11 (business reorganization) or 13 (individual or sole proprietorship reorganization).

The Invisible Hand in bankruptcies.

In economist Adam Smith’s Wealth of Nations, he uses the phrase “invisible hand” metaphorically to demonstrate how each person acting in his own interest combines to promote the good of the community. The same is true in bankruptcy proceedings.

The debtor’s goals in filing for bankruptcy include getting an automatic stay in order to have some breathing room to reassess how to handle the situation. Another goal is to exempt as many assets as possible from the bankruptcy estate that is created by filing the petition, and which will be used to pay creditors. Next, the debtor wants to discharge as much indebtedness as possible, since the previous burden obviously was too high. Finally, by filing for bankruptcy and receiving a discharge, a debtor avoids “cancellation of debt” tax liability that often arises from how the IRS treats relief from indebtedness (26 USC §108). Sometimes not all of these goals can be achieved.

The creditor’s goals in a bankruptcy are to receive as much of the estate assets as possible, obtain relief from the automatic stay to obtain assets of the estate, find facts which would result in a denial of discharge to the debtor (such as hiding assets), or obtain a ruling that the debt owed to that creditor is not discharged at all, such as when the debt was incurred by willful and malicious acts, fraud, or is a domestic support obligation.

The U.S. Trustee’s goal in bankruptcy is to ensure the debtor acts honestly and equitably toward the creditors. This may occur by reviewing the petition, past tax returns, or examining the debtor throughout the case to evaluate which, if any, type of bankruptcy is best for all concerned.

The bankruptcy case trustee (different from the US Trustee’s office) has the goal of getting as many assets into and disbursed through bankruptcy estate, as the trustee makes a commission based on this throughput.

The effect of the automatic stay.

One of the effects of bankruptcy is the feared and revered “automatic stay” imposed by §362 of the Code. But exactly what does it do?

The automatic stay does stop the vast majority of creditor actions against a debtor. It operates as an injunction (with the power of the Court behind it) to stop:

- the commencement, continuation of lawsuits and administrative proceedings;

- efforts to enforce money judgments;

- any act to create, perfect or enforce most liens; and

- offsets of debts owing to debtor.

It does not, however, stop:

- criminal proceedings;

- professional or drivers’ license revocation proceedings;

- paternity, domestic support obligations;

- marriage dissolution cases (except for division of property that is estate property);

- domestic violence proceedings;

- interception of tax refunds under the Social Security Act;

- tax audits or notices of deficiency from the IRS;

- eviction proceedings of non-residential real property where the lease has expired of its own terms;

- continued withholding from earnings (Chapters 11, 13);

- acts to enforce against property that was the subject of a successful relief motion within the previous 2 years in prior case;

- continued eviction of residential property if judgment was entered before the bankruptcy petition was filed;

- acts to perfect or continue perfection of lien that relates back (such mechanics’ liens); and

- a number of other actions.

The penalty for violating the automatic stay can be severe, as a creditor’s violation affects not only it and the debtor, but all other participants in the bankruptcy.

What the bankruptcy estate is made of.

The filing of a bankruptcy petition creates a bankruptcy estate. In a consumer case, it is comprised of:

- all assets of the debtor, and of spouse’s interest in community property;

- all inheritances, bequests, devises, amounts received from divorce decrees or life insurance policies received within following 180 days;

- in a Chapter 11 and 13, the debtor’s earnings through the life of repayment plan; and

- all transfers avoided by the trustee such as fraudulent conveyances or preferential transfers;

minus

- exemptions allowed to be taken under applicable law.

What are California’s exemptions?

California has two sets of exemptions laws. You should consult with your attorney about which set of exemptions is right for you. Generally, however, one is permitted to be used by anyone and includes the statutory homestead exemption; the other is limited to bankruptcy debtors who elect to use the alternative “bankruptcy-like” exemptions.

Some of the hurdles a debtor must clear to get a discharge.

In order to receive a discharge, a debtor:

- must timely file tax returns before the petition is filed;

- must timely file schedules of assets, liabilities, cash flow, intention regarding unexpired contracts;

- must file wage stubs timely; and

- must participate in case and follow the bankruptcy court’s orders.

If the debtor is an individual with primarily consumer debts, he also:

- must take an approved credit counseling course w/i 180 days before filing the petition; and

- must take a financial management course or a discharge will not be granted.

In addition, in a Chapter 7 case where debtor is an individual with primarily consumer debts, the debtor must have current income that is less than median income of the state, or pass the “means” test. This means test is intended to identify whether the debtor has the ability to repay a significant portion of unsecured dischargeable debt. If the test is not passed, the case is “presumed abusive” under Chapter 7(meaning the debtor presumably has an ability to repay a significant amount of otherwise dischargeable debt) and the case normally will be converted to one under Chapter 13, in which case the debtor must commit disposable income in a 5-year plan to repay debts. If the debtor fails to complete the plan, the case may be converted or dismissed.

If the debtor’s unsecured debt exceeds $383,175 and secured debt exceeds $1,149,525, and he does not pass the means test, it is possible the debtor will have to file under Chapter 11 instead of 13, which has similar discharge provisions but is intended for larger, more complex situations.

What debts cannot be discharged?

A discharge generally operates to discharge the debtor from all debts arising before the petition was filed, except:

- most recent taxes due and unpaid;

- taxes due for fraudulent returns or unfiled returns;

- domestic support obligations;

- fines, penalties and forfeitures;

- student loans unless the court determines that requiring payment would impose and undue hardship;

- death, personal injury injuries caused by DUI or under illegal controlled substances;

- criminal restitution orders;

- divorce obligations ordered by family court;

- HOA fees or assessments due after the petition was filed;

- amounts owed under repayment to pension or profit sharing plans under ERISA;

- judgments for fraud or defalcation under securities laws; and

If a creditor establishes the following in proceedings in the bankruptcy court:

- debt for money, property or services obtained by false pretenses (for example credit card debts incurred just before the bankruptcy petition is filed);

- fraud while acting as a fiduciary; or

- willful and malicious injury,

These debts may be found non-dischargeable and may survive the bankruptcy process.

Provisions to discourage multiple filings.

Finally, there are provisions to discourage frequent resort to bankruptcy:

- A Chapter 7 debtor may not receive a discharge if one was received in a previous

- A Chapter 7 debtor may not receive a discharge if one was received in a previous Chapter 13 case filed within the past 6 years;

- A Chapter 13 debtor cannot receive a discharge if one was received in a Chapter 7 case filed within the past 4 years;

- A Chapter 13 debtor cannot receive a discharge if one was received in a previous Chapter 13 ase filed within the past 2 years; and

- No natural person may be a debtor whose prior case has been dismissed within the previous 180 days for willful failure to prosecute the prior case.

If this seems daunting, don’t be concerned. Once explained, it becomes clear.

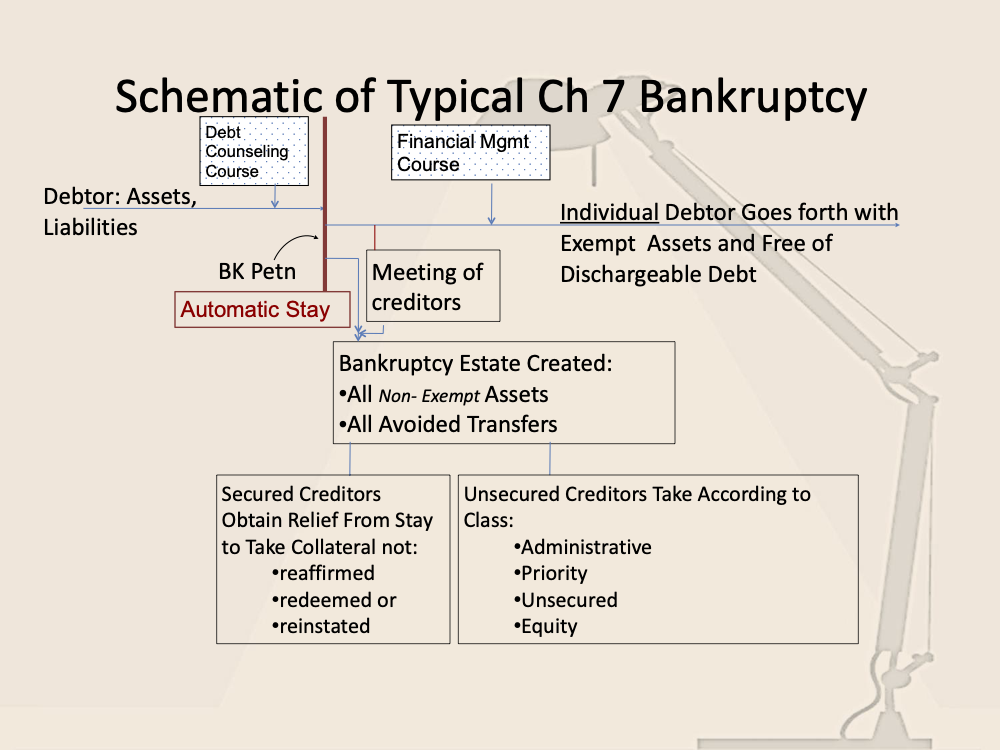

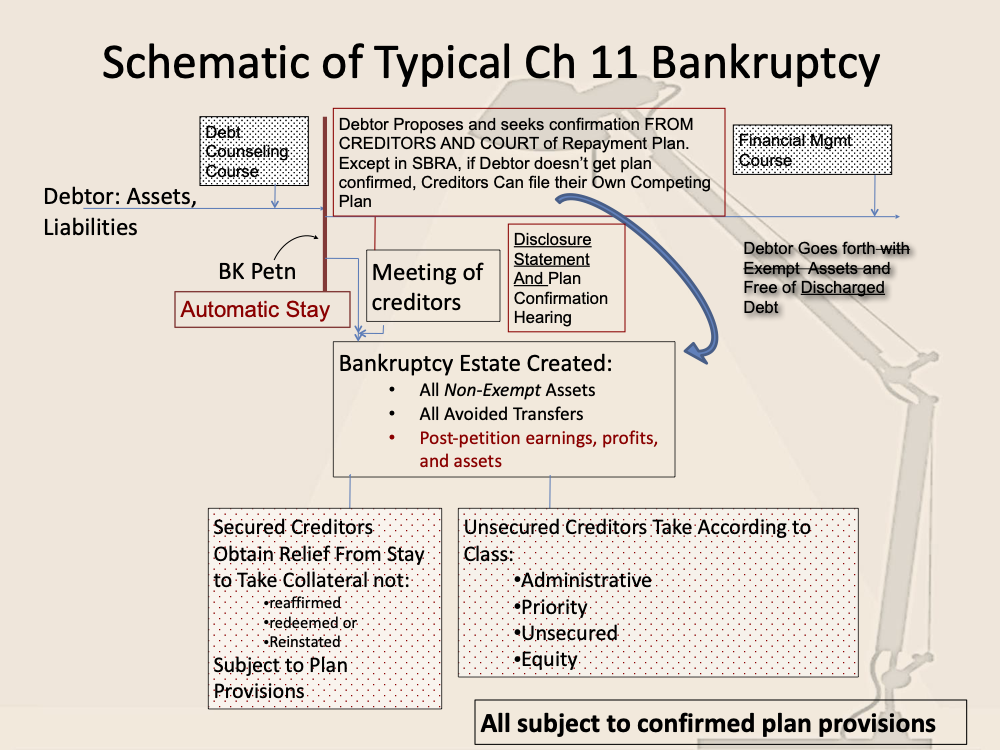

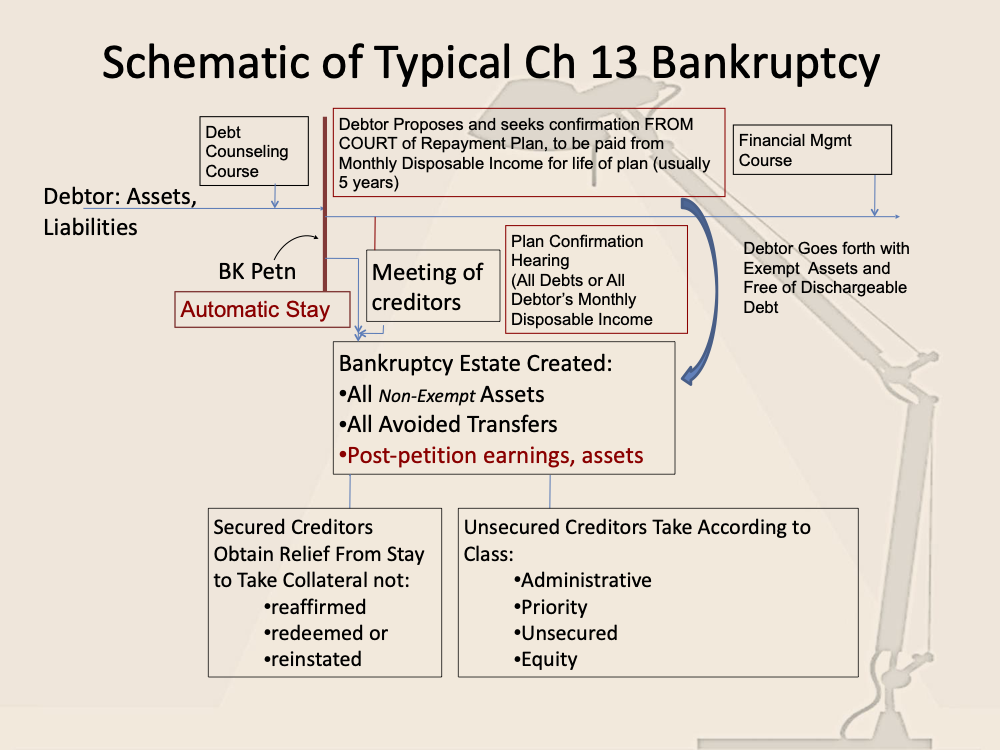

The bankruptcy process in pictures.

Law Offices of Brian Irion is a debt relief agency under 11 USC § 528. We help people and businesses file for bankruptcy to reorganize or relieve debt. If this is the right choice for you or your business, you will know, and if not, you will know the options for yourself, your family, or your business.